Companies Limited by Shares and Companies Limited by Guarantee: As part of creating a company, it’s crucial that one understands all available legal structures for company formation. Two popular structures are “Companies Limited by Guarantee” and “Companies Limited by Shares,” though each structure serves different functions; anyone considering starting their own business must comprehend these differences between them before proceeding further with formation plans.

“Companies Limited by Shares” refers to business entities in which ownership is distributed among shares that are held by shareholders, while “Companies Limited by Guarantee” are businesses where members agree to cover debts if it becomes necessary.

Understanding these distinctions between companies with shares and those without guarantees – their ownership structures, profit distribution processes and advantages will assist individuals and organizations alike when selecting an ideal structure that matches their requirements and goals.

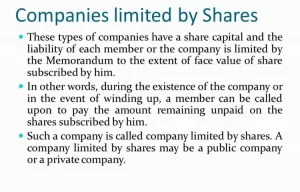

What is the Definition of Companies Limited by Shares?

A limited-by-shares company is a business entity in which ownership and capital have been distributed among individual shareholders via individual shares, each holding equal ownership rights to another in proportion to how many they own. Individual shareholders own different portions of company stock which they can buy, sell or transfer as ownership changes hands over time.

Under this structure, liability for shareholders is limited to what they invested or agreed to pay when buying shares in a company. When sued or required to comply with legal obligations by said company, their assets should generally remain safe; except where personal guarantees were given by shareholders themselves.

Companies limited by shares are commonly employed for commercial ventures or profit-focused business activities, with shareholders’ primary goal being to maximize dividends and profits through ownership of the company and payout of dividends proportionately based on shareholding.

Companies Limited by Shares provide for greater ownership flexibility as shares may be issued to either other companies or individuals, or can even be publically offered at stock exchanges as initial public offerings (IPO). They must comply with regulations in their home jurisdiction in terms of transparency, governance and adherence with applicable laws ensuring transparency, governance and legal compliance for their operations.

Definition of Companies Limited by Guarantee?

Guarantee Companies (CLGs) are business entities in which members pledge a specified sum towards any debts of the company if it were ever to close, unlike an ordinary Company Limited by Shares with no share capital or voting shares.

This structure permits guarantors to provide guarantees for a company; typically a nominal sum, such as PS1, serves as their liability should financial issues or operations cease for whatever reason. Each guarantee represents their maximum liability; contributors to it only when required due to company failure to fulfill obligations.

Companies Limited by Guarantee (CLGs) are frequently used for non-profit, charity, and club formation as they prioritize serving a shared mission over making a profit; any income generated within them tends to stay with the organization itself rather than being distributed amongst members.

Companies Limited by Guarantee typically enact an administrative board or committee for managing its affairs, with members having voting rights and participating in decision-making despite not owning shares in the company.

Companies Limited by Guarantee offer organizations an effective legal structure for seeking funding or grants or donations while simultaneously safeguarding members beyond any guarantee commitment made to them. Companies Limited by Guarantee must adhere to all local laws and regulations when operating within their jurisdictions.

Importance of understanding the differences Between Companies Limited by Shares and Companies Limited by Guarantee

Anyone or organization considering starting their own business needs to understand the differences between Companies Limited by Shares and Companies Limited by Garanty.

Some reasons for understanding their distinction include:

- Legal Structure: Companies Limited by Shares and Limited by Garanty have distinctive legal structures, rights and obligations which should be understood to select an optimal framework for any organization based on its nature, goals, and ownership requirements.

- Liability: These two structures differ considerably in regard to liability structures. Companies Limited by Shares limit shareholder liabilities solely to what was invested or agreed upon when buying shares; companies Limited by Guarantee involve guarantors that commit to paying some amount towards debts of the company if it becomes inactive, thus creating different forms of personal responsibility in decision making and risk assessment processes. It’s vitally important that when making decisions or assessing risk it is clear about your personal liabilities when making important choices or assessments.

- Ownership and Control: Companies Limited by Shares are owned by shareholders who hold ownership rights over their shares, while Companies Limited by Guarantee do not. Understanding ownership and control mechanisms is critical when setting governance structures, making decisions efficiently, voting rights allocation, and any possible issues of legal compliance that might arise with regards to company activities or ownership structures.

- Profit Distribution: Companies limited by shares are traditionally profit driven; shareholders expect returns from their investment through dividends or capital appreciation, with shareholders expected to see dividends and capital appreciation return their investment as dividends or capital appreciation respectively. Non-profit limited by guarantee entities often reinvested their profits into reaching their objectives rather than giving out dividends directly. It’s essential for business managers and stakeholders to understand the distribution of profits so as to create structures aligned with financial goals while simultaneously being sustainable in operation.

- Legal Requirements: Every type of business has specific legal, regulatory, and compliance obligations which need to be considered in order to operate legally, maintain transparency and abide by applicable laws. Knowing and meeting these standards are integral parts of doing business successfully.

Learning the differences between Companies Limited by Shares and Companies Limited by Guarantee can enable individuals and organizations to make an informed decision when it comes to choosing a suitable business structure, aligning their structure with their goals, managing liabilities more effectively, governing more efficiently and operate within legal requirements associated with either type.

Companies Limited by Shares

Companies Limited by Shares (LLCs) are an increasingly popular business structure in which ownership and capital are distributed among shareholders in equal shares. As with other business structures, LLCs must comply with specific legal guidelines when operating under its structure; as an LLC must pay out dividends according to state legislation for shareholder investment purposes and provide shareholders with fair ownership stake.

If this sounds intriguing then here’s everything you should know:

- Shares represent ownership in this arrangement; shareholders can include individuals or companies holding an equal percentage shareholding. They become owners based on this shareholding distribution ratio.

- Company Limited by Shares offers many advantages, with limited liability being one of them. Shareholders’ liability is restricted by their investment or commitment to pay their shares; therefore they are no longer personally responsible for debts that accrue beyond their shareholding commitments.

- Share Capital, Companies Limited by Shares (Limited by Shares) have an issued share capital that represents its total worth; shareholders contribute this capital through buying or allocating shares; right issues or private placements may also contribute.

- Dividends, Companies Limited by shares offer dividends to shareholders as an entitlement from company profits; this distribution depends on how many shares each shareholder holds in the company.

- Transferability of Shares, In general, shares held by companies limited by stock are transferrable allowing shareholders to sell, give away or exchange them to others with greater ease and liquidity. This feature grants shareholders flexibility and freedom when selling off or trading in their shareholdings to new people.

- Governance, Companies Limited by Shares are governed by Articles of Association, applicable laws and regulations, and voting rights at general meetings of shareholders; additionally, they have input in key business matters through voting at meetings of all types and holding general assemblies where this occurs.

- Commercial Ventures, Limited-by-Shares companies provide businesses with a structure for commercial ventures or profit-focused enterprises to operate within. Issuing shares allows these organizations to raise capital while giving the business room to expand as needed.

- Compliance Requirements – Companies Limited by Shares must abide by all local laws and regulations, which include financial reporting obligations such as filing returns with regulatory bodies as well as industry-specific guidelines for their business activities. This could involve meeting filing obligations related to financial reports as well as conducting regular corporate governance reviews to maintain regulatory compliance within their sector.

Understanding the features and advantages of Companies Limited by Shares (LLCs) can assist individuals and companies with making more informed decisions regarding company structure, ownership requirements, liability management, and governance issues. LLCs are widely accepted legal structures which permit commercial activities while safeguarding shareholder interests.

Companies Limited by Guarantee

Companies Limited by Guarantee (CLBGs) is a business structure in which members of a Company Limited by Guarantee are personally liable for its debts.

What You Should Know:

- Companies Limited by Guarantee (LLGs) are managed by members who act as guarantors instead of shareholders and commit to paying an amount towards its debts if it goes bankrupt; each guarantor’s maximum liability is represented in this guarantee amount.

- Non-Profit, Companies Limited by Guarantee are often used by non-profit organizations such as charities, clubs, and professional associations with no intention to make a profit in mind. Their motive lies more with serving a shared mission or objective than making any measurable income for shareholders.

- Limited Liability, As with companies limited by shares (Limited Liability), companies limited by Guarantee provide members with limited liability for personal assets they own in an attempt to safeguard personal finances and reduce any associated liability risks.

- Companies Limited by Guarantee don’t typically have traditional shareholders; ownership typically lies with members collectively. Members often take part in decision-making and voting rights without owning shares or ownership rights themselves.

- Companies Limited by Guarantee do not distribute profits as dividends to members; instead, extra income may be reinvested back into the organization in order to support its activities and attain non-profit goals.

- Companies Limited by Guarantee typically appoint a board or committee of trustees as their chief decision makers for overseeing its affairs, depending on its needs and legal obligations. Governance structures vary between organizations depending on what suits them best.

- Non-Transferability, Companies Limited by Guarantee membership is usually associated with one individual or organization and therefore it cannot easily be transferred.

- Companies Limited by Guarantee must abide by all relevant nonprofit regulations in their local area, which include reporting requirements, transparency measures and any legal restrictions attached to nonprofit status.

- Understanding the characteristics and features of Companies Limited by Guarantee is critical for non-profit organizations to make informed decisions regarding legal structure, liability management, governance requirements, and compliance obligations – ultimately aligning goals within legal boundaries while continuing activities legally.

Comparison Between Companies Limited by Shares and Companies Limited by Guarantee

Liability in Companies Limited by Shares – Shareholders are only responsible for what was invested or committed to pay in order to purchase their shares; their personal assets remain safe while any debts incurred beyond this amount do not require personal repayment from shareholders.

Companies Limited by Guarantee – Guarantors agree to pay towards any debts of the company should it go bankrupt, although only up to what amount was pledged as security and personal assets remain protected from being lost due to this arrangement.

Ownership and Control in a Company Limited by Shares (CBS):

Ownership rights of shareholders correspond directly with their shareholdings; hence affecting control through voting rights as well.

Companies Limited by Guaranty, Under this structure, ownership, and control are held collectively by members who act as guarantors of the business. Control may be exercised through voting rights and participation in decision-making processes.

Profit Distribution at Companies Limited by Shares:

Companies limited by shares can expect shareholders to experience dividends and capital appreciation as returns on their investments.

In companies Limited by Garantie, Surplus income will generally be reinvested back into the organization in order to reach non-profit objectives; no dividends are given out as rewards to members.

Use and Purpose of Companies Limited by Shares (CBS):

Companies limited by shares are used to describe commercial ventures that aim for profit as well as businesses looking for growth or investment opportunities.

Companies Limited by Guarantee (CLGs), CLGs refers to non-profits, charities, clubs or associations which strive to achieve social, community or professional objectives.

Legal requirements and compliance:

Companies Limited by Shares (CLA): CLA companies must adhere to commercial laws and regulations which apply specifically to commercial entities, which includes financial reporting requirements as well as filing annual returns with authorities.

Companies Limited by Guarantee (CLGs): must abide by all relevant laws and regulations, such as transparency requirements for non-profit organisations as well as reporting obligations.

Understanding the various company structures can assist individuals and organizations with selecting a structure suited for their objectives, liability concerns and ownership preferences. They may also select one suitable to their legal requirements or profit distribution goals – something which ensures alignment with an organization’s mission while simplifying management and compliance within that chosen structure.

Considerations for Choosing Between Companies Limited by Shares and Companies Limited by Guarantee

There are various factors to keep in mind when making the choice between companies limited by shares and those limited by guarantee.

Here are the keys ones:

- Nature and Goals of Your Organization: Carefully consider the nature and goals of your organization before choosing its structure. Companies Limited by Shares might be best for commercial activities while Companies Limited by Guarantee might be better for non-profit purposes or being focused more towards community, professional or social initiatives.

- Decide upon an acceptable level of liability protection: Companies Limited by Shares provide limited liability for shareholders to help safeguard personal assets; Companies Limited by Guarantee offer protection to guarantees but commit them to contribute an agreed-upon sum should bankruptcy occur. You and your stakeholders should assess any associated risks before choosing their level of protection from personal liability.

- Funding and Investment Considerations: Before considering setting up your organization, carefully assess potential sources of funding as well as investors that might be interested in it. Companies Limited by shares offer an ideal framework for equity investments; their regulations allow share issuance easily while drawing investors who seek returns from their investment portfolios. But if donations, membership fees, or grants form your primary funding sources then limited-by-guarantee companies might provide more suitable solutions than companies limited by shares.

- Assess Membership and Governance Requirements: Determine which structure for decision-making and governance best satisfies your organization. Shareholders in companies limited by shares have the power to exercise their voting rights based on share ownership; members in limited-by-guarantee companies may cast votes as collective owners of their organization; therefore it’s essential that members or shareholders understand how much control and involvement their members or shareholders desire in your operations.

- Long-Term Sustainability and Adaptability: When making decisions regarding long-term company structures, consider their adaptability and sustainability over the long haul. Assess whether their chosen structure aligns with future growth plans, objectives or funding sources as well as whether moving from one structure to the other could be easy or requiring considerable modification efforts. Flexibility should also be evaluated so as to achieve effective transition between structures as a key consideration.

Before choosing between companies limited by shares and companies limited by guarantee, consider these factors for an informed decision that suits your goals, liabilities, funding sources, governance structure, and long-term viability needs.

Conclusion

Companies limited by shares and those that are limited by guarantee have distinct business structures that are designed to serve different purposes and industries. Companies that are limited through shares can be profit-driven companies that have investors who are part of the business and are paid dividends. However, companies that are limited by guarantee are not-for-profit organizations with members who act as guarantors and contribute small amounts to the company’s obligations for specific causes.

Understanding the distinctions between these two types of business is crucial for investors, entrepreneurs, as well as those who want to establish and join an organization that is in alignment with their ideals and values whether for the sake of commercial success or society’s greater good.