IFSC Code and Swift Code are codes used to identify individuals for electronic money transfers to financial institutions like banks. When making transfers between banks, these codes must be mentioned. When international transfers take place using Swift codes, an IFSC code may also be necessary for India – we’ll cover this topic further below so our readers are better educated on these important codes.

Swift Code

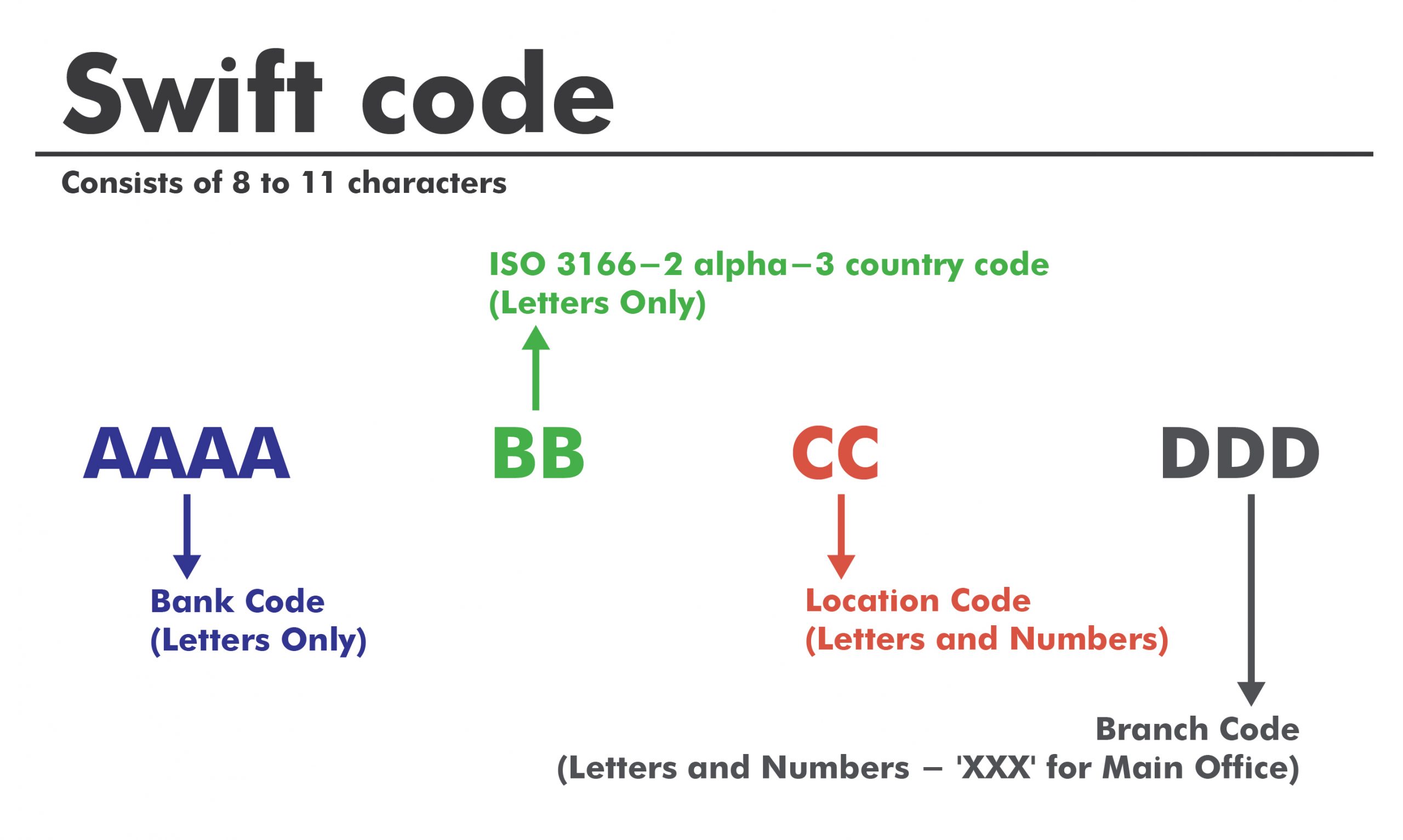

Swift codes were developed by the International Organization of Standards (ISO) to facilitate funds and communications transfers between banks globally. SWIFT stands for Society for Global Inter Bank Financial Communications. Swift codes consist of eight or one alphanumeric number that represents an institution by its name and address, with five to six alphanumeric characters representing its nation (for instance DEUTUS33XXX stands for Deutsche Bank in New York in the USA). If transferring money between banks abroad and local ones banks typically charge fees that typically range between $25-35 USD for every transfer transaction.

- SWIFT codes are assigned to financial and non-financial institutions alike, consisting of either eight or 11 alphanumeric characters that make up its unique code. Below you can see details regarding each code assigned.

- The first four characters represent the bank’s code (Letters only; AAAA for instance).

- The next two characters represent country codes (Letters only i.e. BB).

- Two characters following each letter represent a location code (letters and numbers i.e. 1C).

- The last three characters may be used to indicate branch codes (letters and numbers (DDD)).

IFSC Code

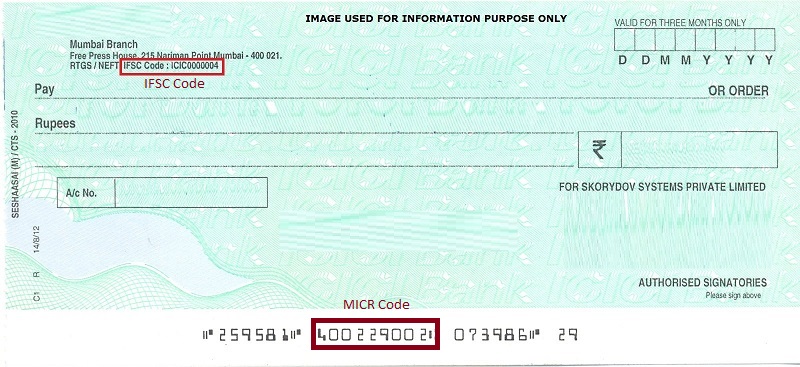

If you live in India and want to transfer funds between banks here, knowing their respective IFSC codes makes this task simple and efficient. IFSC stands for Indian Financial System Code and is needed when using any of the three payment methods created by RBI- RTGS, NEFT or CEMS. IFSC codes contain 11 characters; its first four reveal what institution the code represents. It should be noted that banks include their IFSC codes on every checkbook they issue – making it easy for one to identify what theirs is by checking its slip. Here are a few examples of such codes.

- The code comprises eleven alphanumeric characters.

- The initial four characters represent the bank number.

- 5. The fifth letter in the alphabet is 0.

- The last six characters are branch codes.

- Central Bank of India provides each bank branch in India with an IFSC number, which allows interbank transfer systems to send transfers to their appropriate branch of a bank.

Differences between IFSC Code and Swift Code

Below are the key differences between SWIFT codes and IFSC codes, as detailed in this paragraph:

- SWIFT Code stands for Society for Worldwide Interbank Financial Telecommunication Code; while IFSC code stands for Indian Financial System Code.

- SWIFT codes are globally-recognized codes used for international credit transfers between banks and communication between them. At the same time, an IFSC Code serves as the identification number of individual branches to enable electronic money transfers.

- The SWIFT code has been approved by the International Organization for Standardization (ISO). Meanwhile, the Reserve Bank of India has developed the IFSC code.

- Only certain banks can participate in international wire transfers with SWIFT code capabilities; by comparison, the IFSC code is extended to all Indian banks.

- SWIFT codes contain between eight and 11 characters, in contrast to the IFSC code which comprises eleven letters.

- Charges associated with international funds transfers (SWIFT code) tend to be more costly than national transfers (IFSC code).

- Locate your bank’s SWIFT number through their website or statement of account; its IFSC code will be printed in their checkbook and on the RBI website.

Table:

| BASIS FOR COMPARISON | SWIFT CODE | IFSC CODE |

|---|---|---|

| Stands for | Society for Worldwide Interbank Financial Telecommunication Code. | Indian Financial System Code |

| Meaning | A worldwide recognized identification code used at the time of international credit transfer between banks and also when there is an exchange of messages between banks is the SWIFT code. | A code that distinctively identifies a bank branch involved in an electronic fund transfer system in India IFSC code. |

| Developed by | International Organization for Standardization (ISO) | Reserve Bank of India (RBI) |

| Applies to | Only SWIFT-enabled banks. | All the bank branches in India. |

| Characters | 8 or 11 | 11 |

| Fee | High | Nominal |

| Found in | Bank’s website or the account statement. | Bank-branch checkbook and RBI website. |

Similarities Between IFSC Code and SWIFT Code

Here’s a brief overview of the commonalities between the IFSC Code and the SWIFT Code:

I. Identification of Financial Institutions

A. Each IFSC Code and SWIFT Code are alphanumeric codes that help provide a unique identification of financial institutions.

B. They are a method to recognize banks in the financial system worldwide.

II. Accurate Routing of Funds

A. Both codes play an important part in ensuring the correct transfer of funds through transactions.

B. They can prevent erroneous actions which could result in money being transferred to the wrong branch or institution.

III. Assistance to Secure Transactions

A. IFSC Code and SWIFT Code help to ensure the security of financial transactions.

B. Correct codes can prevent unauthorized access and ensure funds are directed to intended recipients.

IV. Facilitation of Electronic Transactions

A. Both codes are crucial to facilitate electronic transactions, whether in a specific country or internationally.

B. They allow for the automatic processing of transactions which reduces the requirement for manual involvement.

V. Enhancement of Cross-Border Trade

A. Each IFSC Code and SWIFT Code are vital to assisting international trade and investment.

B. They facilitate seamless cross-border transactions and encourage international economic activity.

VI. Integration with Payment Systems

A. IFSC Code and SWIFT Code are integrated into payment protocols and systems.

B. They assure compatibility between different financial institutions and systems.

VII. Global Standardization

A. Both codes use standards-based formats accepted by the global banking industry.

B. They are a key factor in the reliability and consistency of financial communications.

VIII. Importance for Banking Operations

A. Banks use both codes to effectively handle various kinds of transactions.

B. A. Properly using these codes improves bank processes and customer support.

IX. Role in Financial Communication

A. Both codes are essential components in the exchange of information between financial institutions.

B. They aid in establishing safe and reliable channels for the exchange of information.

X. Continued Relevance in Digital Era

A. The two IFSC codes and SWIFT codes continue to be relevant even in a digital world.

B. They adapt to the changing technology and are still the basis of modern financial systems.

XI. Influence on Customer Experience

A. The proper use of the IFSC Code and SWIFT Code helps to provide a more pleasant customer experience.

B. Making sure that the correct codes are used helps reduce transaction delays and errors.

XII. Cross-Institution Compatibility

A. Both codes permit the compatibility of different banking and financial establishments.

B. They help bridge the gap between different entities, providing smooth financial transactions.

XIII. Role in Fraud Prevention

A. Correct IFSC Code and SWIFT Code use can help in preventing fraud.

B. Correct coding decreases the chance of funds being diverted because of malicious intention.

XIV. Basis for Regulatory Compliance

A. Financial regulations typically require precise coded transactions for reporting and auditing.

B. Both codes help to ensure the integrity and transparency of financial systems.

XV. Support for Financial Inclusion

A. Proper utilization of the IFSC Code and SWIFT Code aids in the financial inclusion effort.

B. They allow businesses and individuals to be part of a global financial system

How to Locate and Verify IFSC and SWIFT Codes?

Verifying and locating IFSC or SWIFT codes is crucial for ensuring secure and accurate financial transactions. Here’s how you get it done:

Locating and Verifying IFSC Code:

- Check Your Passbook or Cheque Book: Most Indian banks print the IFSC code of the branch on the checkbook or on the cheque leaves. Check for a string of alphanumeric characters that are usually located in the vicinity of the bank’s name as well as address.

- Official Website of the Bank and Mobile Application: Log in to the bank’s official website or mobile application. A lot of banks offer information on the branches’ IFSC code on the platforms. Go to the section for branch locators.

Locating and Verifying SWIFT Code:

- Contact the bank of the recipient: If you’re sending an international wire transfer, you must contact the bank that you’re sending it to and request the bank for the SWIFT code. Be sure to provide them with the correct information to ensure that you get the proper code.

- The website of Recipient Bank: A lot of international banks have the SWIFT code on their official sites. Go to the bank’s site and search for information on international transactions.

- SWIFT Code Directories: Many online sites offer SWIFT code directories in which you can look up codes by name of the bank, location, or country. Websites such as swiftcodes.org and the SWIFT website provide this service.

- Correspondent banks: When the bank of your recipient does not have an easily accessible SWIFT code, you could locate it through one of the correspondent banks for your bank that handles international transactions.

Tips for Verification:

- Double-check accuracy: Ensure the codes you get are valid and match with the desired recipient, branch, or the. Minor mistakes can result in delays or even failures.

- Consult Official Sources: Use Official Sources Always go to official sources, such as banks’ websites, official statements, and verified databases to get codes.

- Contact Customer Support: If you’re unsure whether a particular code is accurate Contact the customer service at your bank to get help. They will be able to verify the code and help you through the procedure.

- Use reputable directories: When using online SWIFT code directories, make sure to use trustworthy and well-known sources to avoid false or fraudulent information.

- Keep Tracks: Always keep a list of the codes you’ve used to make transactions. This is useful to refer to in the event there are any problems.

Be aware that being sure of the authenticity of IFSC as well as SWIFT codes is vital to successful transactions, so make sure you take the time to check and double-check the details prior to making any financial transfer.

Conclusion

The main distinction between these two codes lies in their intended uses; the SWIFT code is typically employed when international transfers of funds take place between banks while an IFSC code would be more suitable in cases of domestic interbank funds transfers.