IFSC and MICR Code: Society for Worldwide Interbank Financial Telecommunication (SWIFT), is an international non-profit cooperative owned and run solely by member banks. SWIFT code allows money transfers between two banks worldwide utilizing an electronic message transfer system that sends messages in pre-defined formats as soon as transactions take place globally.

Contrarily, an IFSC code is utilized when the transfer of funds between banks occurs within India’s geographic limits. This alphabetic code identifies which branch of a bank participates in electronic fund transfer systems for fund management.

SWIFT codes and IFSC codes are two distinct identification codes required when initiating an electronic money transfer. There are some key differences between the two that will be discussed within this excerpt from an article.

Define the MICR Code

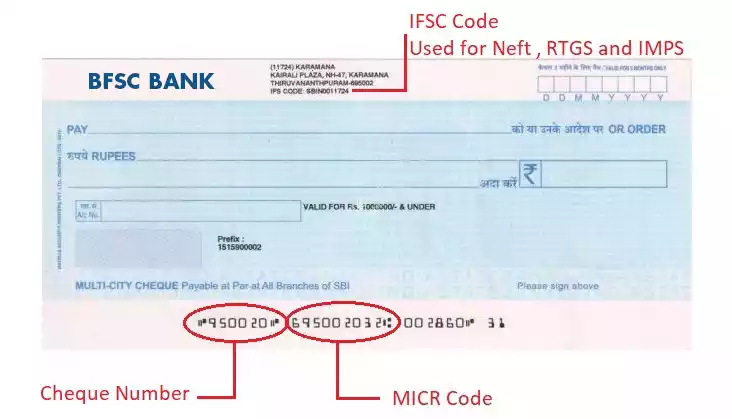

MICR stands for Magnetic Ink Character Recognition, which is used to process cheques. This code allows you to easily process thousands of checks, which used to be a major headache. The code is nine digits long and only contains numbers. The code identifies the branch and the bank that issued the check. The first three digits represent the city, the next three represent the name of the bank and the last three tell the location of the branch.

This MICR code for each branch is unique. MICR, unlike optical character recognition (OCR), has a very low error rate. It can also be read by humans.

Define the IFSC Code

Bottom line The Indian Financial System Code, commonly referred to as an IFSC code, is a unique identification number used to locate individual branches that participate in electronic money transfer systems such as National Electronic Fund Transfer (NEFT) or Real Time Gross Settlement (RTGS) within India.

The code comprises alphanumeric characters which can be found below:

- The initial four letters of the alphabet represent a bank’s code.

- Five characters contain zeros. The last six characters represent a branch code.

- Central Bank of India provides every bank branch in India with an IFSC code, which interbank transfer systems use to send transactions directly to its branch.

Differences Between IFSC and MICR Code

Below are the primary differences between SWIFT codes and IFSC codes, as outlined below:

- SWIFT Code stands for Society for Worldwide Interbank Financial Telecommunication Code while an IFSC Code denotes Indian Financial System Code.

- SWIFT Codes are internationally-recognized codes used for international credit transfers between banks. Information also moves freely between them. Meanwhile, an IFSC Code provides unique identification numbers of institutions used for electronic money transfer services.

- The SWIFT code is approved by the International Organization for Standardization (ISO). However, its counterpart–IFSC code–is created by the Reserve Bank of India (RBI).

- SWIFT codes only permit certain banks to participate in international wire transfers; by contrast, all Indian banks receive an IFSC code.

- SWIFT codes consist of 8 (or 11) characters, as opposed to an IFSC code which consists of 11.

- Fees associated with international funds transactions using SWIFT codes tend to be higher than for domestic transfers (IFSC codes).

- Find SWIFT codes online as well as in a bank’s statement of account and checkbook; while IFSC codes can be found in Bank-branch checkbooks and the RBI website.

Table:

| Parameter | SWIFT Code | IFSC Code |

| Full Form | Society for Worldwide Interbank Financial Telecommunication Code | Indian Financial System Code |

| Purpose | Used for international transactions between banks across the world | Used for domestic transactions within India |

| Length | Consists of 8-11 alphanumeric characters | Consists of 11 alphanumeric characters |

| Format | The first 4 characters represent the bank code, the next 2 characters represent the country code, the next 2 characters represent the location code, and the last 3 characters are optional and represent the branch code | The first 4 characters represent the bank code, the next character is 0, and the last 6 characters represent the branch code |

| Issued By | Issued by Society for Worldwide Interbank Financial Telecommunication | Issued by Reserve Bank of India |

| Unique Identifier | Identifies a specific bank in a specific country | Identifies a specific bank branch in India |

| Usage | Used for international wire transfers and cross-border transactions | Used for electronic funds transfers (EFT) and real-time gross settlement (RTGS) transactions within India |

| Examples | Citibank in New York has a SWIFT code of CITIUS33 | HDFC Bank in Mumbai has an IFSC code of HDFC0000149 |

Similarities between IFSC and MICR Code

There are a few similarities between IFSC (Indian Financial System Code) and MICR (Magnetic Ink Character Recognition) codes, however, they have different functions in relation to financial and banking transactions.

Purpose:

- IFSC Code IFSC codes are used to identify a specific branch of a bank participating in the NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement) systems in India. It is necessary when moving funds electronically between various banks.

- MICR Code The MICR code is used to process checks. It assists in identifying the branch and bank that the check was drawn at. The check is printed with a distinct font on the top of the check to aid in the automated processes and sorting.

Components:

- IFSC Code IFSC code is comprised of eleven alphanumeric numbers. Four characters signify the bank’s code, while the fifth character is typically “0”, while all the other characters are the branch’s specific code.

- MICR Code MICR code is comprised of nine numbers. The first three digits are the code for the city, the middle three digits are that of the code for banks, and the final three digits are Branch Code.

Usage:

- IFSC Code is used for online transfer of funds or electronic payments.

- It’s utilized for processing checks at banks. When a deposit is made on a check then these MICR codes are read out by computers to confirm its authenticity check as well as to make it easier for the process of sorting and routing.

Medium:

- IFSC Codes: used to facilitate electronic transactions and online processes.

- MICR Code: It is used for physical checks.

Uniqueness:

The two IFSC as well as MICR codes are used for distinguishing banks with branches. An IFSC code is unique to every branch, while a MICR code is unique to every branch of a bank as well.

When to Use IFSC Code and MICR Code?

A. Scenarios Requiring IFSC Code:

- Online fund transfers: when initiating National Electronic Funds Transfer (NEFT) real-time gross settlement (RTGS) as well as Immediate Settlement Service (IMPS) transfers between branches or banks of different banks.

- Interbank Electronic: Mandates Establishing Electronic Clearing Service (ECS) requires automated regular payments such as loans or utility bills.

- Application for mobile banking: Making use of mobile banking applications to transfer money or make payments to banks that are not in the same branches.

- Add Beneficiaries: When adding an additional beneficiary to online transactions, you can ensure the correct routing of the funds.

B. Scenarios Requiring MICR Code:

- Cheque Payments Cashing or depositing cheques The MICR code aids in the processing and verification of whether the legitimacy of the payment is genuine.

- An automated Clearing House (ACH) is used for the online clearing and settlement of checks as well as for facilitating bulk transactions like dividends, salary credit, or pension payments.

- Payment Processing for Checks, Banks utilize MICR codes for reading, sorting, and processing cheques using high-speed machines for settlement and clearing.

- Verification of the authenticity of a cheque to ensure that the check being used for payment is authentic and has not been altered.

C. Overlapping Situations:

- Cheque payments with online clearing In the event that the cheque is cleared online via mobile applications and web-based interfaces, the IFSC along with MICR codes can be utilized in conjunction to ensure the correct processing.

- Interbank Transfers that use Cheque Authentication Certain banks may have the use of both IFSC or MICR codes to make online funds transfers with cheque authentication. This ensures secure routing and accuracy.

It’s crucial to know that the application of IFSC and MICR codes will vary according to the specific guidelines of various banks and other financial institutions. Always consult your financial institution or bank provider for the most up-to-date and current information regarding the use of IFSC or MICR codes for a variety of transactions

Future Trends and Developments

A. Evolution of Transaction Technologies:

- Blockchain Integration Blockchain Integration: Blockchain integration could transform the way transactions are conducted and improve security efficiency, transparency, and speed.

- Instant Payments: Continuous technological advancements in real-time payments may reduce the dependence on codes for the transfer of funds which will make transactions easier to process.

- Biometric Authentication: Biometric authentication like fingerprints or facial recognition can be a key factor in authorizing transactions, thus reducing the requirement to input codes manually.

B. Replacement Possibilities for MICR Code:

- Digital Cheques: the growth of digital cheques as well as their direct digital processing could diminish the importance of MICR codes for verifying cheques and processing.

- QR Codes: QR codes that contain pertinent transaction details could substitute or enhance MICR codes for specific transactions, particularly in mobile banking apps.

C. Enhanced Security Measures:

- Multi-Factor authentication: Banks may adopt more robust multi-factor authentication strategies to protect transactions that go beyond codes-based systems.

- AI-powered Fraud Detection: Machine learning algorithms could be utilized to detect fraud in real time. This can help improve the security of transactions.

- Biometric Security: Data such as fingerprints or facial recognition could be the main method for transaction authorization, thus reducing the possibility of unauthorized access.

D. Sustainability Initiatives:

- Paperless Transactions: As the world progresses toward digitalization, there may be an increased focus on reducing transactions on paper, like cheques, which may impact the validity to MICR codes.

- Environmentally friendly solutions: Financial institutions might adopt greener technology that has less environmental impact, possibly changing the way that the use of transaction codes.

E. Regulatory Changes:

- Regulation Shifts: The changes in Financial regulations, as well as policies, can result in innovations in the transaction system and affect the way codes such as IFSC as well as MICR are utilized.

- Transfers between countries: If cross-border transactions become more widespread and more widespread, international standards for identifying transactions could be developed, affecting the codes used to route.

F. Continuous Industry Collaboration:

- Interoperability: Collaboration between financial institutions and banks could result in the creation of more interoperable, standardized, and user-friendly payment systems.

- Customer-Centric Solutions: Feedback from customers and changing needs could shape the future of transaction technologies that provide a more intuitive and seamless experience for customers.

Being aware of the latest trends and developments is essential for people as well as businesses and financial institutions to stay on top of the ever-changing technology of transactions and codes.

Conclusion

The main distinction between these two codes lies in their usage; SWIFT codes are utilized for international transfers of funds between banks while IFSC codes are generally limited to domestic interbank fund transfer transactions.