MICR and OCR: MICR and OCR technologies are becoming more commonly employed by businesses today. MICR stands for Magnetic Ink Character Recognition while OCR refers to Optical Character Recognition; both technologies share similar functions but this article will explore their differences and specific applications despite sharing similar traits.

Meaning of OCR

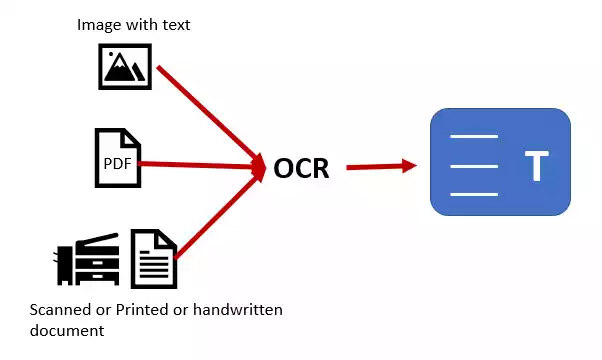

- OCR (Optical Character Recognition), is a scanner that scans pages containing text. OCR software then converts this image of text into editable ASCII text format for use by word processing applications to make changes. OCR works by extracting grid dots from images of text and converting this array of dots to equivalent ASCII texts that a computer can render as letters, numbers, or special symbols.

- OCR software can recognize all sorts of printed characters. Traditional OCR was less successful at scanning script font and handwriting, but with newer smart systems’ greater accuracy, they can recognize a wider variety of fonts and even produce output in a format similar to what they scanned in.

- OCR accuracy depends heavily on the quality of the scanner used, with 1,200 dots/inch texts taking longer to scan but providing higher accuracy than 72 dots/inch text documents.

Meaning of MICR

- MICR (Magnetic Ink Character Recognition) is similar to character scanning but utilizes magnetic ink instead. To use MICR scanning technology, documents are placed under a scanner that converts magnetic information into text characters – this technology is frequently employed by banking systems for quickly processing large volumes of cheques.

- Banks using MICR print the bank code, cheque number, and account number on cheques with special magnetic ink containing iron oxide particles that allow characters to be read easily even when there are overwriting or marks on them. Magnetic printing makes these characters easily legible.

- MICR applications typically utilize characters from fonts such as E-138 or CMC-7; in India, Canada, and the UK however, E-13B characters are used at the bottom of cheques to print MICR characters.

History of MICR

The development of Magnetic Ink Character Recognition, commonly known as MICR, began around the middle of the 20th century. Implementation in banking sectors worldwide soon followed suit.

Here is a short history lesson on this groundbreaking technology:

- The 1950s: The American Bankers Association recognized that an efficient method was necessary for processing checks efficiently, and initiated a project to develop technology which could automate check processing.

- 1955: The American Bankers Association contracted Stanford Research Institute to design an automated check processing system.

- 1958: Bank of America in Los Angeles became the pioneering institution to implement MICR for practical purposes, processing checks automatically with magnetic ink and special readers.

- Since the 1960s: MICR technology has seen rapid expansion across American banks. Most have adopted MICR to streamline check processing with improved efficiency and accuracy.

- Since its introduction in the 1970s: MICR technology has gained wide adoption throughout many nations that recognize its benefits for secure and efficient check processing.

- 1980:The American National Standards Institute issued standards to facilitate MICR reading and printing across banking systems and equipment, to ensure compatibility.

- Since 1990: MICR processing has become more integrated with automated banking systems as computer technology advances. High-speed MICR sorters and readers allow for quicker check processing.

- Today: MICR technology remains an integral part of check processing systems in banks worldwide. It provides high accuracy, reliability, and compatibility with current banking systems – although its usage has decreased considerably due to digital payment methods becoming more popular.

MICR technology has revolutionized check processing, leading to greater efficiency and fewer errors. Yet MICR still remains an integral component for financial institutions worldwide despite its decreased prominence over the years.

History of OCR

OCR’s history spans decades and can be marked by technological innovations and character recognition enhancements.

Here is a snapshot of some major milestones in its evolution:

- The 1950s: RAND Corporation developed the “Statistical Machine Recognition System”. This device allowed it to read characters printed on punched cards.

- The 1960s: OCR technology advanced rapidly during this era with more sophisticated algorithms and hardware. OCR systems could now recognize characters printed on documents and convert them to machine-readable texts.

- The 1970s: In the 1970s, OCR technology saw significant advancement with more sophisticated algorithms and higher accuracy rates, as OCR systems could recognize different fonts, sizes, and styles of documents.

- The 1980s: OCR became more widely utilized commercially during this decade with desktop computer technology making OCR accessible for businesses and individuals alike. The processing power also greatly increased during this period.

- The 1990s: In the 1990s, OCR technology experienced a major transformation. Digital document management and the internet led to an explosion in demand for efficient and accurate OCR solutions; software was created that recognized and processed text within scanned images.

- The 2000s: OCR technology advanced during this decade due to advancements in image processing algorithms and machine learning. OCR systems became more accurate at recognizing complex layouts as well as multilingual text.

- Since 2005: OCR technology has become more integrated and adopted across industries and applications, being utilized for document digitization, data extraction from forms processing automation software systems, and text recognition on mobile devices.

OCR technology is now widely utilized across industries such as finance, healthcare, and retail. Furthermore, advancements in computer vision and deep learning continue to make OCR even more useful.

Importance of MICR and OCR in the data processing

MICR and OCR technologies play an essential role in data processing across various industries and sectors, with some key points that demonstrate their value being highlighted here.

- Efficient Data Capture: MICR and OCR technologies facilitate efficient data capture from forms, documents, invoices, and checks, automating data entry without manual transcription and saving both time and resources by eliminating transcription errors while saving valuable resources for other uses. They reduce errors while saving both effort and energy in data capture processes.

- Accuracy and reliability: MICR and OCR offer accurate data processing with reliable extraction. MICR’s magnetic ink reader ensures accurate recognition of characters found on financial documents like checks. OCR technology employs sophisticated algorithms to extract characters accurately from scanned images for reliable extraction of characters for data extraction.

- Speed and Efficiency: MICR and OCR technology enhance processing speeds and efficiencies by automating data extraction and capture. By processing large volumes of text or documents at a faster rate than manual data entry, they allow organizations to streamline operations and increase productivity.

- Data Analysis and Integration: MICR and OCR technologies facilitate seamless data capture into digital systems and databases, which enables further data processing, analytics, and integration into other systems or applications such as CRM or ERP systems.

- Cost Savings: Both MICR and OCR offer significant cost-cutting opportunities in data processing. Labor costs can be reduced through reduced manual data entry, which reduces risk and financial loss from errors that might otherwise happen without automation processes allowing faster turnaround time and improved operational efficiency.

- Compliance and Data Security: MICR/OCR technologies ensure both compliance and data security. MICR is widely utilized by banks for check processing, adhering to industry standard formats and security measures. OCR allows organizations to protect sensitive information by digitizing documents.

- Streamlined Workflows: MICR/OCR technologies enable organizations to streamline their processes and enhance document management. By digitizing documents into digital formats, MICR/OCR solutions facilitate retrieval, searching, and archiving processes – significantly decreasing physical storage needs while improving efficiency for document administration.

MICR and OCR play an integral part in data processing because they enhance accuracy, speed, efficiency and cost reduction – while at the same time revolutionizing how organizations process and handle data – allowing them to focus their resources on tasks with added value while increasing productivity. These technologies have changed how organizations handle and process their information and can now focus on tasks with an increased return.

Understanding MICR (Magnetic Ink Character Recognition)

MICR stands for Magnetic Ink Character Recognition and is primarily utilized by banks to recognize characters printed with magnetic ink, providing fast and accurate reading on financial documents and checks.

- Magnetic Ink: MICR employs an exclusive ink containing iron oxide particles for printing characters in E13B or CMC7 font. Due to its magnetic properties, MICR scanners and readers make reading this ink much simpler.

- E13B Fonts and CMC7: These are standard MICR fonts used to print characters. Each font combines zero through nine special symbols such as transit symbols and field separators; their arrangement and design allow MICR readers and processors to read accurately what has been printed out.

- MICR Readers and Scanning Devices: These devices are specifically designed to capture, interpret and read magnetic ink characters. Utilizing magnetic sensors that detect magnetic ink and convert it to digital data. Commonly found in financial institutions or banks for processing, sorting, verifying, and sorting.

- Check Processing: MICR technology is essential in processing checks, as its signature line holds crucial information such as bank routing number, account number, and check number. MICR readers are capable of quickly reading this data for various banking processes like check clearing or fraud detection.

- Accuracy and reliability: MICR technology delivers accurate character recognition. Magnetic ink and special fonts enable clear printing with reduced errors during reading; providing financial institutions with reliable data processing and transactions.

- Compatibility: MICR was designed to integrate seamlessly with existing banking processes and systems. Standard fonts and formats are used when printing MICR to ensure compatibility among banks and financial institutions – this makes integration with check processing workflows seamless while reducing system modification needs.

MICR technology is an integral component of banking operations, enabling accurate and efficient processing of financial documents and checks. Utilizing magnetic inks, fonts, and reading devices that facilitate accurate character recognition results in reliable banking operations that run more smoothly and efficiently.

Understanding OCR (Optical Character Recognition)

Understanding OCR OCR stands for Optical Character Recognition and converts handwritten or printed text into machine-readable forms using computer algorithms and image processing technology. Characters extracted from documents, images, or other visual sources include documents, images, and visual sources like documents.

- Image Capture: You can do this using an optical scanner, camera, or smartphone; images taken from books, magazines, printed documents or any other source containing text may be suitable.

- Character Recognition: OCR works by scanning captured images and recognizing text or characters within them using advanced algorithms that analyze the size, shape, and visual features of characters to accurately recognize them.

- Text Extraction: OCR technology converts characters recognized into machine-readable text for editing, storage or digital processing purposes. OCR is versatile enough to be applied across a range of applications.

- Document Digitization: OCR is an essential element of document digitization, providing efficient retrieval and storage by converting paper documents to digital formats that can be searched or edited, eliminating manual data entry processes for rapid information access.

- Data Extraction: OCR allows for the extraction of specific information from documents. For instance, OCR can extract names, addresses, and invoice numbers from receipts, forms or invoices – extracts that can then be automated processed, analyzed, or integrated with another system.

- Automated Form Processing: OCR technology has become widely utilized for automating form processing. It can extract data from structured documents like surveys or application forms and populate it directly into databases or systems, thereby streamlining data entry, decreasing errors, and increasing efficiency.

- Handwriting Recognition: Though OCR systems typically focus on printed texts (such as documents), some also offer handwriting recognition capabilities to digitize documents and forms more efficiently. Such systems analyze and interpret handwritten characters for digitizing purposes.

OCR technology offers many advantages for both efficiency, accuracy, and cost savings. OCR reduces human error while saving time by eliminating manual data input. Furthermore, digitization makes documents searchable while providing advanced analytics features.

What is the Difference between OCR and MICR?

- OCR (optical character recognition) can convert any text into digital format; on the other hand, MICR scans only special characters such as letters.

- Fonts come in all shapes and sizes; for MICR applications, however, special fonts such as E-138, CMC-7 and CMC-7 should be considered.

- OCR ink can come in any variety. Meanwhile, MICR requires special ink made of iron oxide that has magnetized properties.

- MICR output from banks can be utilized for different applications depending on its use, while OCR results can also be beneficial in various circumstances.

Table Difference:

| Inspect | MICR | OCR |

|---|---|---|

| Full Form | Magnetic Ink Character Recognition | Optical Character Recognition |

| Technology Principle | Uses magnetic ink and specialized readers/scanners to detect and interpret characters | Uses image capture and computer algorithms to recognize and extract characters from scanned documents |

| Application | Primarily used in banking and finance for check processing | Used in various industries for document digitization, data extraction, and forms processing |

| Character Recognition | Limited to numeric and special characters (0-9, special symbols) | Supports alphanumeric characters, multilingual text, and handwriting (depending on the system) |

| Ink/Font | Requires special magnetic ink (E13B or CMC7 fonts) | Works with standard printed or handwritten text, no specific ink or font requirement |

| Accuracy | Highly accurate due to specialized ink and standardized fonts | Accuracy varies based on document quality, font type, and layout complexity |

| Implementation Cost | Relatively higher due to specialized equipment, ink, and font requirements | Relatively lower with the use of standard hardware and software |

| Document Compatibility | Specifically designed for checks and financial documents | Compatible with a wide range of documents and text sources |

| Industry Focus | Primarily focused on banking and finance | Used across industries, including finance, healthcare, retail, and document management |

| Limitations | Limited character recognition capabilities, sensitivity to ink quality and contamination | Sensitivity to document quality and formatting, challenges with handwriting recognition |

| Benefits | High accuracy and reliability, compatibility with existing banking systems | Efficient document digitization, data extraction, and automated forms processing |

What Does the Future Hold for MICR and OCR?

MICR and OCR’s future is defined by technological advances and changing requirements in data processing and document management, so here are a few trends and developments which could have an enormous impact on their development in the near future.

- Automation and Efficiency: As industries and businesses continue to optimize processes and automate, MICR and OCR will become key technologies. MICR will help streamline check processing while decreasing manual intervention for improved efficiency; while OCR automates data extraction from documents for faster and more accurate processing of information.

- Integrating AI and Machine Learning: Combining MICR/OCR techniques with artificial intelligence (AI), machine learning (ML), and other techniques will greatly expand their capabilities. AI/ML algorithms improve character recognition accuracy while accommodating complex document layouts; additionally, they adapt to different languages and fonts, leading to more reliable data processing solutions. This integration will lead to more efficient and reliable solutions.

- Advanced Document Analysis: MICR and OCR will soon be capable of more advanced document analysis, with the semantic interpretation of the text, contextual interpretation and the extraction of relevant data being integrated into these advances. These improvements will allow for deeper analyses, data insights, and intelligent automation across a range of industries.

- Handwriting Recognition Can Be Difficult: Attempts at Handwriting Recognition Have Promised Improvement: OCR software that accurately interprets handwritten documents is notoriously challenging to master, yet research and development efforts on neural networks and deep-learning techniques have shown promise for improving the accuracy of handwritten text recognition. Future breakthroughs may lead to robust OCR systems capable of accurately reading handwritten documents.

- Mobile and Cloud Integration: As mobile devices and cloud computing become more widespread, MICR and OCR technology will increasingly become integrated into mobile apps and cloud platforms for real-time processing of data capture as well as improved accessibility across devices and locations. This will facilitate real-time document capture while offering real-time processing speeds with seamless document capture processes that provide improved accessibility across devices and locations.

- Security and Fraud Detection: MICR is crucial for check processing as long as efforts to enhance security and combat fraud exist, while OCR assists in the detection of fraudulent practices by analyzing documents, detecting anomalies, and flagging suspicious patterns across industries.

- Integration With Emerging Technologies: MICR/OCR integrates seamlessly with emerging technologies like Blockchain, IoT, and edge computing for enhanced data security, traceability, and real-time processing capabilities of financial transactions and applications that require large volumes of data processing.

MICR/OCR will continue to adapt as data processing requirements evolve, providing accurate, intelligent, and efficient processing of printed or handwritten text.

Conclusion

MICR (Magnetic Ink Character Recognition) and OCR (Optical Character Recognition) are two distinct technologies utilized for various purposes. MICR is mostly used by banks to process and read checks using magnetic inks for high-quality character recognition. However, OCR is a more flexible technology that converts handwritten or printed documents into machine-readable format. extensively employed to scan documents, enter data, and text extraction software. Both technologies assist in the process of automating the process of data entry, both are suited to particular needs in particular situations, with MICR being specifically designed for check processing, and OCR providing broader applications to different sectors.