Plant and Machinery: This article investigates the differences between plant assets and machinery assets, with an emphasis on usage, depreciation factors, maintenance considerations and classification issues that affect financial reporting, operational efficiency and resource allocation. Understanding these assets’ differences will enable industries and businesses to effectively utilize them and make strategic use of them for maximum profitability.

What Is a Plant?

A “plant” refers to assets used for supporting industry or business operations and providing infrastructure. Examples of plant assets include buildings, land and other fixed structures which serve to bolster operations as long-term assets vital to business or industry operations; tangible as well as intangible such as patents or licenses are integral components to creating the ideal conditions to produce goods or services efficiently.

What is Machinery?

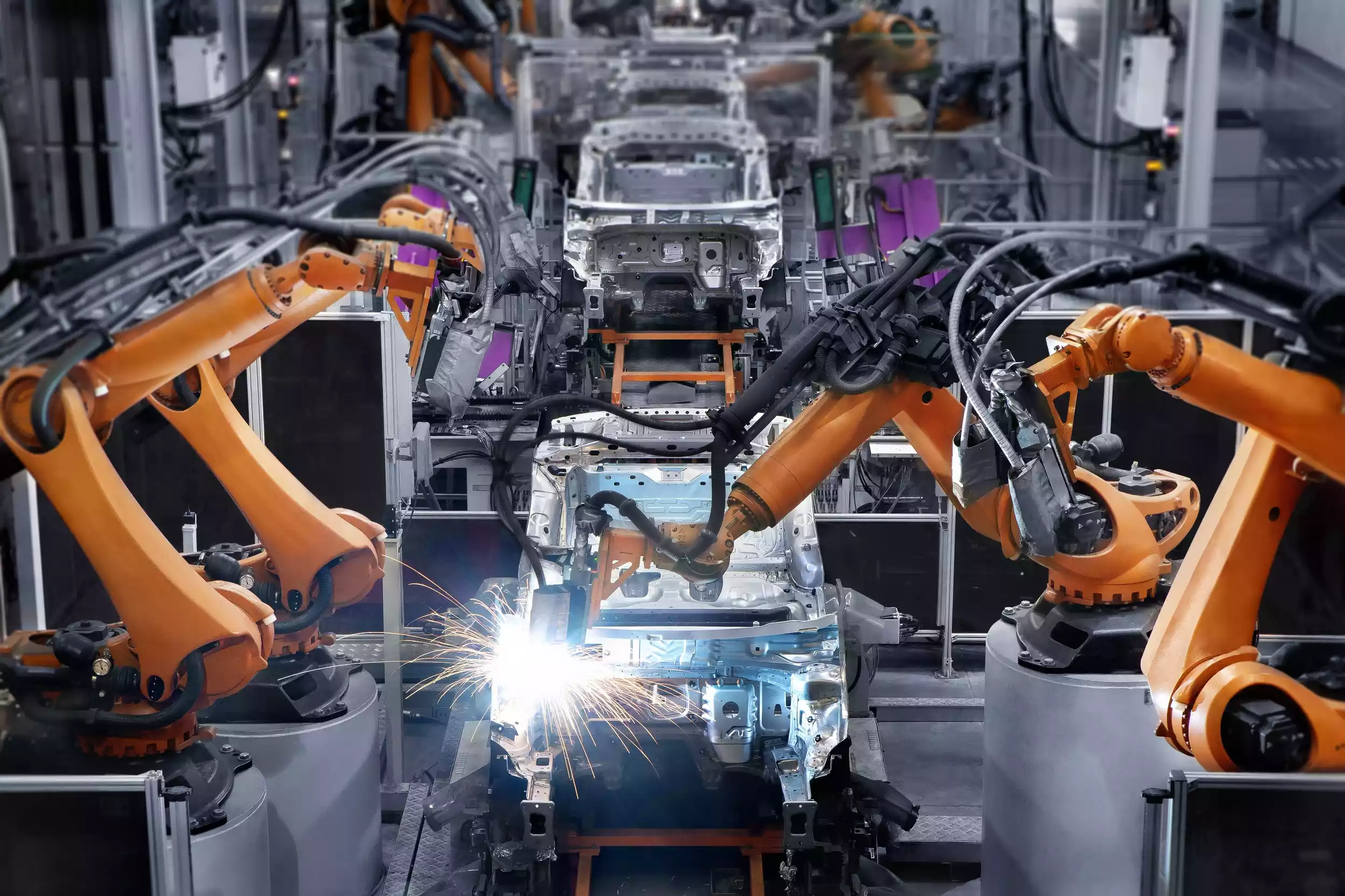

Machinery assets refer to mechanical devices, tools, and equipment used for specific production processes or tasks. Machinery assets can be moved around at will; some machines can even perform manufacturing or construction functions while also serving agriculture or transportation needs. Manufacturing equipment, assembly lines, cranes and tractors can all fall under this asset class category which often needs regular maintenance due to heavy use; machinery assets play an integral part in keeping businesses and industries operating smoothly and effectively.

Characteristics of Plant

Characteristics of Plant assets include:

- Immovability: Plant assets tend to be permanent assets that provide the physical environment in which business operations take place. Examples include buildings, land, and other fixed structures which serve as platforms upon which these operations take place.

- Long-Term Investment: Plant assets can be considered long-term investments by industry or businesses since their purpose is usually years or decades in duration.

- Support infrastructure: Plants provide essential infrastructure support for businesses. Their presence forms the basis for many activities ranging from manufacturing, storage, offices, and other facilities to support various forms of manufacturing and storage operations.

- Tangible and intangible assets: Plant Assets include both tangible assets such as buildings and equipment as well as intangible ones like trademarks or licenses.

- Depreciation: Depreciation is an inevitable component of plant assets, as their value declines over time due to wear-and-tear, obsolescence, and aging. Depreciation expenses should be recorded as expenses within financial statements to reflect this decrease.

- Maintenance Considerations: Maintenance is key to the long-term health and efficiency of plant assets, from preventative inspections to repairs and renovations. In order to keep assets in top shape and avoid significant degradation, regular inspections, repairs, and renovations should take place.

- Initial Investment Can Be Substantial: Plant assets require an upfront investment that may be substantial. Construction or acquisition costs associated with buildings, land, and infrastructure often comprise a considerable portion of a company’s capital expense budget.

- Long-Term Planning: Careful consideration should be given when making decisions concerning plant assets that require long-term ownership, such as location, size, and design.

- Less mobile: Plant assets tend to be less mobile than machinery assets; they are less easily moved around. Once installed, however, these assets should remain put and not be relocated frequently.

Businesses should understand these characteristics to effectively manage, maintain, and allocate their resources toward infrastructure needs.

Characteristics of Machinery

Characteristics of machinery assets include:

- Movable: Machine assets can be moved or relocated as necessary, thanks to being portable machines suited for adaptability in various production processes or work environments.

- Specific functionality: Machine assets are specifically tailored to carry out specific functions or tasks. Equipped with tools or mechanical components that enable precise operations like manufacturing, transportation, and construction; machine assets make an essential addition to any company’s inventory of assets.

- Machinery assets come in all forms imaginable: from simple tools to complex industrial equipment such as vehicles, assembly lines, and manufacturing machinery. Additionally, machinery assets may include mechanical devices that specialize in specific industries or tasks.

- Wear and Tear: Machine assets will gradually wear out over time due to use. Mechanical stress from continuous operation, harsh conditions or high-intensity work may require maintenance, repairs or replacement parts at some point.

- Depreciation: Machinery assets, just like plant assets, are subject to depreciation as their value decreases with age; businesses account for this depreciation in their financial statements.

- Maintenance that Focuses on Function: For optimal performance and to prevent breakdowns, machinery assets require regular maintenance. Regular inspections, lubrication, and calibration services must also be arranged to keep machinery operating effectively.

- Cost Variability: Machinery assets can range greatly in cost depending on their size, complexity, and functionality. Some machines may incur steep upfront costs while others might be more affordable or available to rent or lease.

- Advancements in technology: Advancements in technology have an enormous effect on machinery assets’ values. Machinery may become more efficient or automated as new technologies emerge, which impacts productivity and operations.

- Technological advancements: Utilisation of machinery assets for specific tasks and production processes. These machines are tailored to be both efficient and precise, which enables businesses to increase productivity while meeting desired results.

- Variability in lifespan: The expected lifespan of machinery assets depends on many variables such as usage intensity, maintenance schedules, and quality standards. Some machinery will only last a short while due to rapid technology obsolescence while others could live on longer with proper upkeep and upgrades.

- Lifespan variability: Businesses must understand these characteristics to properly oversee their machinery assets, plan replacements, and upgrades, maximize use, and ensure operational efficiency.

Differences Between Plant and Machinery

There are several key differences between plant and machinery assets.

These differences can be categorized into various aspects:

Nature of Assets:

- Plant assets are typically immovable and fixed in nature, including buildings, land, and other structures.

- Machinery assets are generally movable and used for specific tasks or production processes.

Usage and Applicability:

- Plant assets are used to support business operations and provide infrastructure, creating a physical environment.

- Machinery assets are used in production processes or specific tasks, enabling efficient and precise operations.

Depreciation and Maintenance:

- Plant assets usually have a longer lifespan and lower depreciation rate due to their immovable nature and durable construction.

- Machinery assets may have a shorter lifespan and higher depreciation rate due to wear and tear from regular use and technological advancements.

Cost Considerations:

- Plant assets often involve significant initial investments and higher maintenance costs due to their immovable and infrastructure-focused nature.

- Machinery assets can vary in cost depending on their complexity, functionality, and size, with some machinery being more affordable or available for lease or rental.

Mobility and Transferability:

- Plant assets are generally immovable and not easily transferable. They are designed to serve a specific location and are not intended for frequent relocation.

- Machinery assets can be relocated and transferred to different locations as needed, offering more flexibility and adaptability to changing operational requirements.

Proper classification and understanding of these differences are crucial for businesses and industries. It enables accurate financial reporting and accounting treatment, efficient resource allocation, effective maintenance planning, and optimal utilization of both plant and machinery assets.

Table Difference?

Here’s a table summarizing the differences between plant and machinery assets:

| Aspect | Plant Assets | Machinery Assets |

| Nature of Assets | Immovable and fixed | Movable and task-specific |

| Usage and Applicability | Support business operations, | Used in production processes or provide infrastructure |

| Depreciation and | Longer lifespan, lower | Shorter lifespan, higher |

| Maintenance | depreciation rate | depreciation rate |

| Cost Considerations | Significant initial investments, | Varies based on complexity,higher maintenance costs |

| Mobility and | Generally immovable, not | Movable and transferable as |

| Transferability | easily transferable | needed |

This table provides a concise overview of the key differences between plant and machinery assets, highlighting their characteristics in terms of nature, usage, depreciation, maintenance, cost considerations, and mobility.

Importance of Proper Classification

Businesses and industries should take measures to classify assets such as plant and machinery correctly for several reasons, including:

- Accounting and Financial Reporting: Accurate asset classification is key to maintaining the credibility and accuracy of financial statements. Plant and machinery assets require separate accounting standards compliance measures which affect balance sheets, income statements and cash flow statements. With proper classification comes transparency, conformance to accounting standards compliance as well as accurate financial analysis.

- Tax Considerations: Classifying assets may have tax repercussions for businesses. Plant and machinery assets may be subject to different rates and rules that could impede tax planning and deductions, leading to greater expense overall. By properly classifying their assets, businesses can ensure they comply with tax laws while increasing deductions while decreasing liability.

- Operational Efficiency: Understanding the distinctions between machinery and plant assets is critical for effective resource allocation and management. Businesses can plan and allocate their resources based on each asset type’s specific requirements, while classifying assets can optimize maintenance schedules and replacement plans as well as utilization, improving overall operational efficiency.

- Asset Management: Effective asset classification practices provide businesses with an advantage in asset management practices, enabling them to track the condition, performance, and lifecycles of machinery and plant assets more accurately and proactively manage them for proactive maintenance, timely repair, and informed decisions regarding upgrades, replacements or disposal.

- Budgeting and Cost Control: By distinguishing plant assets from machinery, businesses can establish accurate budgeting and cost control processes. Understanding specific costs associated with each asset type allows businesses to allocate resources efficiently, plan capital expenditures accurately, and make informed financial decisions.

- Compliance and Auditing: Proper classification supports audits and ensures regulatory compliance by giving auditors and regulatory agencies clear visibility of asset categories, financial reporting, valuations, and valuation methods – aiding in the audit process while decreasing risks for noncompliance.

- Confidence of Investors and Stakeholders: Accurate asset classification enhances investor and stakeholder trust. Furthermore, transparent reporting on plant assets and machinery aids lenders and investors in building this rapport.

Accurate classification of assets like plant and machinery is vital for financial reporting, taxes, operational efficiency, asset management, cost control, and compliance purposes – ultimately helping businesses make informed decisions, maximize resource allocation efficiently, uphold financial integrity, and remain transparent in their practices.

Conclusion

Machinery and plants are both instruments that are utilized in a variety of situations. “Plant” typically refers to massive, fixed assets that are used in manufacturing or manufacturing functions including machines, factories, or facilities. “Machinery,” on the other hand, is a specific equipment or mechanical device employed for various functions including farming, construction or manufacturing. Both are tangible assets that have a significant value, they are also comprehensive industrial structures, while machinery is a set of equipment or devices that perform specific purposes in different sectors.